It was the first subordinated bond by a Turkish FI this year.

Turkey’s IsBank became the first lender in the country to tap the international markets this year with an upsized USD750mn T2 issue that tightened from 8.25% IPTs to just 7.75%. It was also the first benchmark-sized Turkish FI international non-TRL denominated Tier II paper since Akbank 2028s issued in February last year.

Gauging the demand for the notes, ING’s Senior High Yield Credit Strategist Oleksiy Soroka notes the deal reflected a healthy appetite for yield and new issues from the Turkish bank sector among emerging market investors.

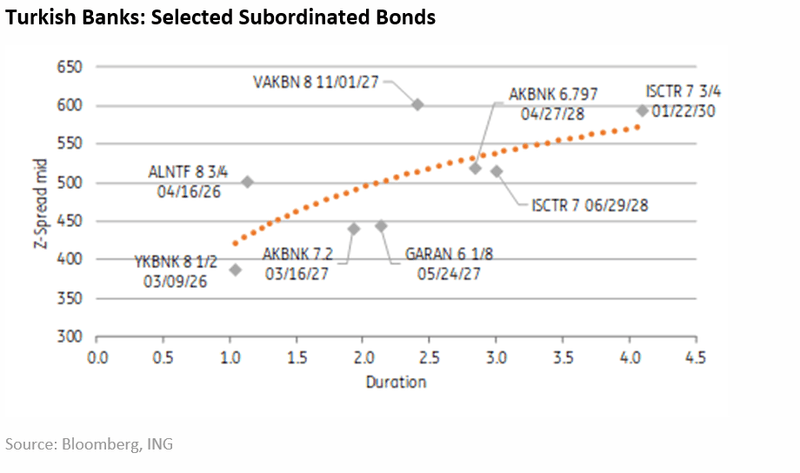

“In terms of valuations, we believe that the notes ended up pricing somewhat wide to the fair value, but the price has quickly adjusted upwards to 101.50-100.75 currently. At 101.8, the YTC and ZSPRD are 7.31% and 569bp, respectively. Compared to ISCTR 06/2028 (at 101.25, YTC of 6.59% and GSPRD of 497bp), the new bond currently offers a 72bp pickup which is no longer particularly generous for the call term extension.”

“Currently, as can be seen from the scatter chart below, while VAKBN 11/27 appears to be the cheapest bond on the Turkish bank T2 subs curve, we also note that it is much less liquid, given the smaller size ($228m). We also note that the success of the ISCTR sub bond may prompt other banks to consider tapping this type of instrument later in the year.”

IsBank was somewhat opportunistic with this issue after spotting a favourable window and tapping the market even as it was already well-capitalised for the year. Its capital adequacy ratio stood at 17.76% as of 3Q2019.

“However, with TL loan growth expected to pick up this year, to 16-17% from 9-10% in 2019, the CAR was expected by the bank to be diluted somewhat to >15% by YE 2020. Therefore, the new issue will allow some further buffer over and above the minimum CAR regulatory requirement (which was at 12.05% in 2019),” Soroka concludes.